Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. Income tends to be the category that business owners underutilise the most. No, but it’s considered necessary by all kinds of companies seeking to categorize all of their transactions so that they can be referenced quickly and easily. This coding system is important because the COA can display many line items for each transaction in every primary account. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

Long-Term Liabilities

- Investment in non-current assets reflects a commitment to future business sustainability and efficiency, as they are used in the production of goods, supply of services, or for rental to others.

- These categories correspond to the major sections of financial statements (balance sheet and income statement).

- When you create your own version of it, your types of accounts might vary based on your business.

- This organization aids in the efficient recording and retrieval of financial data.

It also helps with recording transactions and organizing them by the accounts they affect to help keep the finances organized. A business transaction will fall into one of these categories, providing an easily understood breakdown of all financial transactions conducted during a specific accounting period. Size – Set up your chart to have enough accounts to record transactions properly, but don’t go over board. The more accounts you have, the more difficult it will be consolidate them into financial statements and reports. Also, it’s important to periodically look through the chart and consolidate duplicate accounts. For a small business without the need to identify departmental or divisional information a simple 3 digit chart of accounts numbering system can be used.

Digit Chart of Accounts Numbering System

Today, businesses manage countless complex and multifaceted financial transactions. To keep track of everything, finance teams rely on a chart of accounts (COA) to help them organize, record, and monitor these transactions accurately. Skynova’s all-in-one invoicing and accounting software makes it easy to keep accurate financial records for your company. Track all of your accounting information – income, expenses, sales tax, payments, and more – in one place and run regular reports to review your company’s financial statements. When you list and number your types of accounts, your current assets come first.

Streamline your accounting and save time

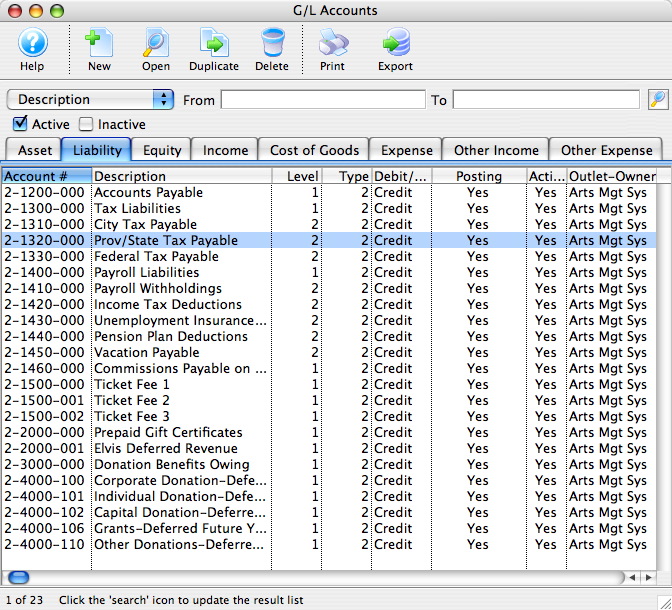

A chart of accounts (COA) is a comprehensive catalog of accounts you can use to categorize those transactions. Ultimately, it helps you make sense of a large pool of data and understand your business’s financial history. A chart of accounts is organized using a hierarchical structure, starting with broad categories and then breaking them down into more specific subcategories. This structure generally follows a numerical system, with each account assigned a unique number. The numbering system typically groups accounts of the same type together, making it easier to navigate and maintain the chart.

Looking To Get Started?

In setting up a COA, it’s important to have a systematic structure that is easily understandable and scalable as the company grows. As time goes by, you may find yourself wanting to create a new line item for each transaction, but doing so could litter your company’s chart and make it difficult to navigate. 20 best restaurant accounting software of 2021 A diagram depicting a company’s hierarchy or chain of command, its business segments, functions, and departments. A record in the general ledger that is used to collect and store similar information. For example, a company will have a Cash account in which every transaction involving cash is recorded.

Incorporate your newly created COA into your accounting software or manual accounting system. This might involve setting up each account within the software and ensuring that it aligns with your COA structure. Run a series of transactions through your COA to test its functionality and practicality. For example, you might use the 1000 series for current assets, starting with Cash at 1010, Accounts Receivable at 1020, and so on, leaving room between numbers for future accounts. Tailor these categories and subcategories to reflect your business’s unique operational needs, ensuring they capture all types of transactions your business encounters. For example, all asset accounts might start with a 1, liabilities with a 2, and so on, leaving room within each category for additional accounts.

It’s designed to be intuitive and scalable, allowing for future growth without requiring a complete redesign. Liabilities represent the financial obligations of a business that are due to be paid to external parties. These are settled over time through the transfer of economic benefits including money, goods, or services. The cost of goods sold (COGS) refers to how much it costs your company to produce an item or service that you sell. It includes direct costs, such as freight, storage, shipping, direct labor to build these products, and the cost of parts.

A chart of accounts, or COA, is a complete list of all the accounts involved in your business’ day-to-day operations. Your COA will most often be referred to when recording transactions in your general ledger. Consider creating separate line items in your chart of accounts for different types of income.

Leave a Reply